- #QUICKBOOKS 2018 DESKTOP PRINTING 1099 SOFTWARE#

- #QUICKBOOKS 2018 DESKTOP PRINTING 1099 PLUS#

- #QUICKBOOKS 2018 DESKTOP PRINTING 1099 DOWNLOAD#

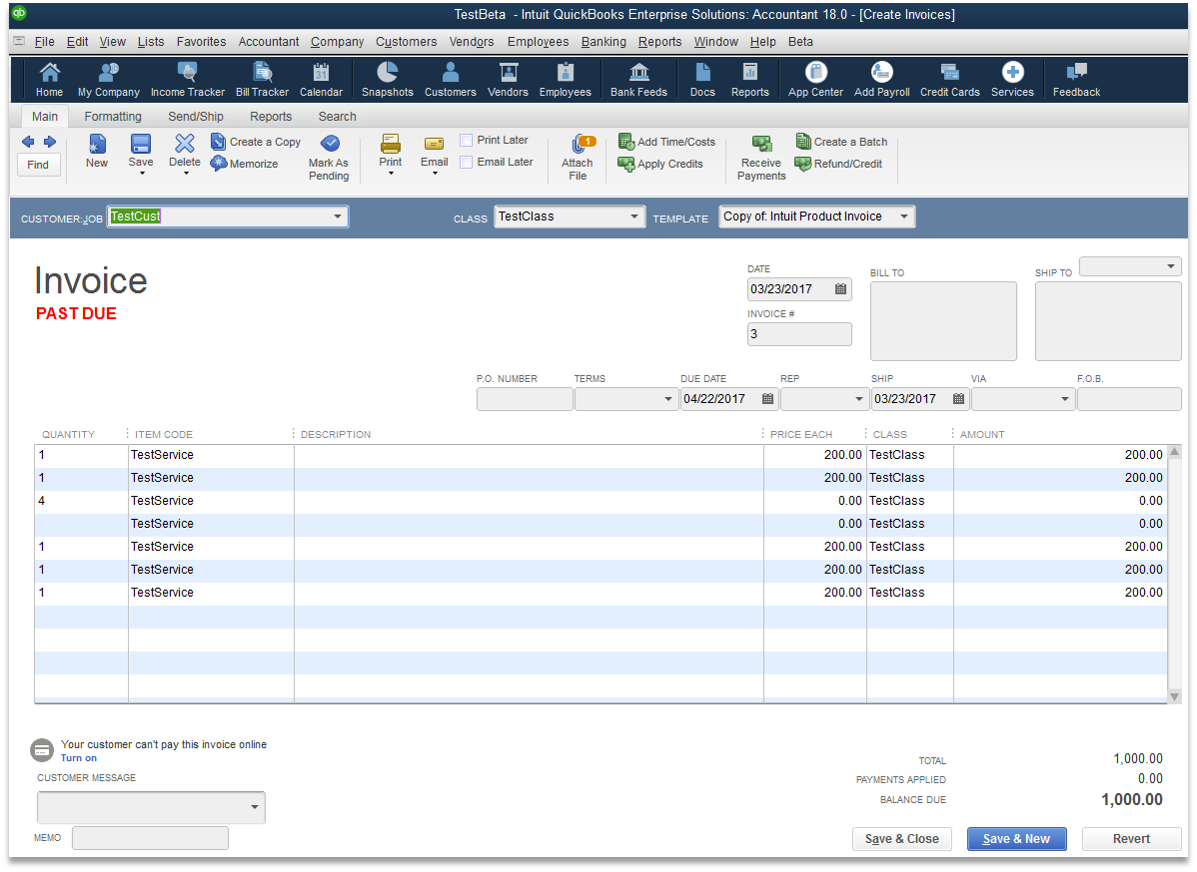

Think of a service-type business that needs the ability to provide estimates, and then turn those estimates into invoices.

Simple Start is a great fit for someone like a graphic designer. The right user for QuickBooks Online Simple Start You can integrate with other available applications to further accommodate your business needs. There are 20-plus built-in reports for reviewing financial data. You can also prepare and print 1099-MISC thru QBO. Lastly, you can customize QBO with reports and apps. Include payroll as an added subscription feature, and you can pay W-2 employees and file payroll taxes. If you’ve previously used QuickBooks Desktop, you can import your data into QuickBooks Online (QBO). The chart of accounts is limited to 250 accounts.

#QUICKBOOKS 2018 DESKTOP PRINTING 1099 DOWNLOAD#

You can also print checks, record transactions, and download bank and credit card transactions. With this version, a user can post unlimited invoices and estimates, charge sales tax, and snap photos of receipts, so they’re ready for tax time. Simple Start also offers bank-level security and encryption. Data is automatically backed up in this version.

QuickBooks Simple Start includes an online account for one full-access user, with the ability to invite up to two accountant users. These users would file their taxes within their personal tax return (1040) on Schedule C. Any individual needing to keep track of expenses or receipts, and mileage, would benefit from Self-Employed. So, what kind of work makes sense for QuickBooks Online Self-Employed? If you’re a writer, an Uber driver, or a real estate agent, for example, this version would be the right fit for you. The right user for QuickBooks Online Self-Employed Basic reporting, including the Profit & Loss statement, and an Income Tax Summary, are provided for reviewing your business performance. You can even track your bank and credit card activity in QuickBooks by downloading the accounts directly into the software.

#QUICKBOOKS 2018 DESKTOP PRINTING 1099 SOFTWARE#

The software calculates estimated quarterly taxes, tracks your mileage, and records Schedule C deductions, which are your business expenses. You can also separate business from personal spending, and create invoices, using QuickBooks payments to receive payment.

#QUICKBOOKS 2018 DESKTOP PRINTING 1099 PLUS#

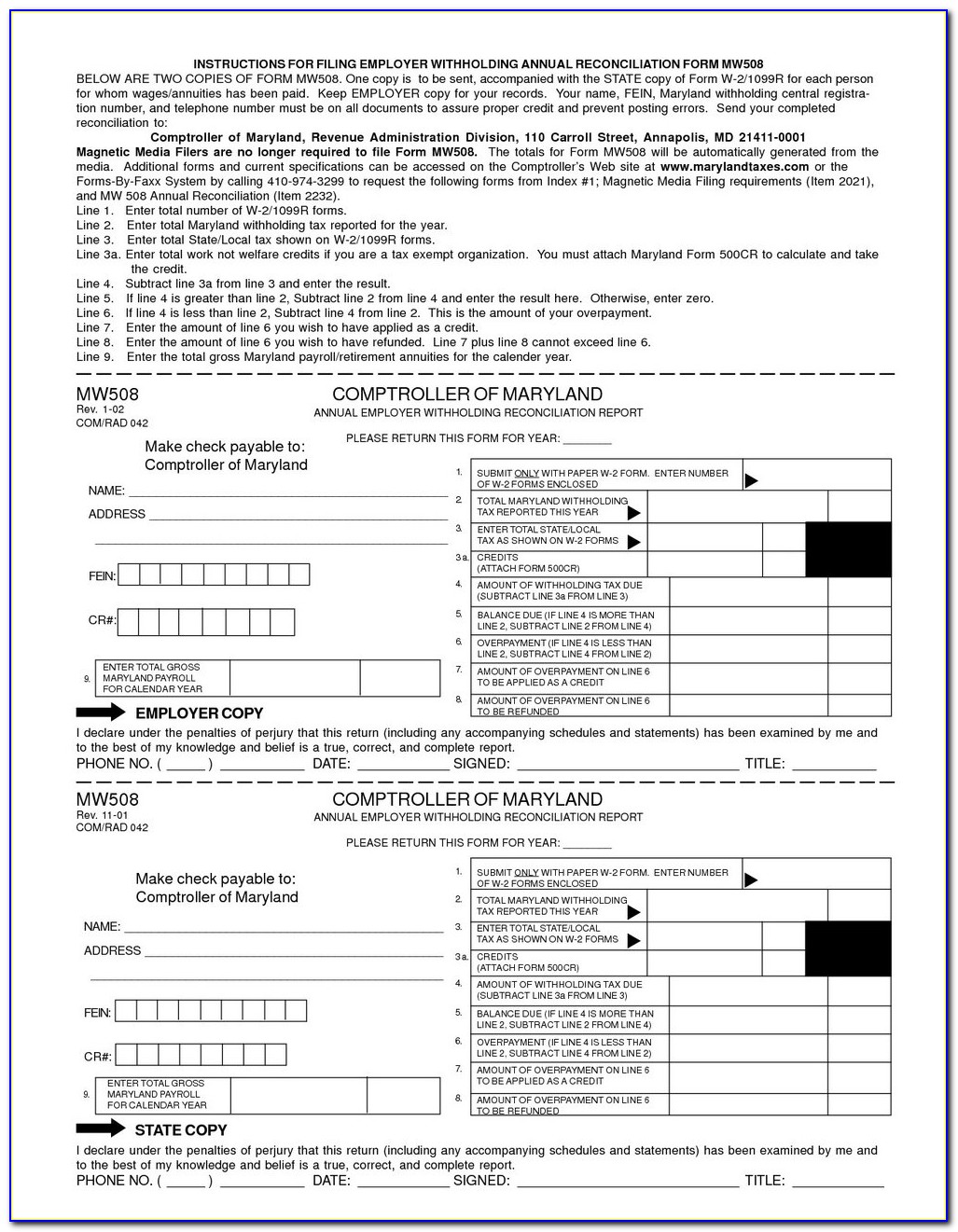

QuickBooks Self-Employed allows for one user plus one accountant user. Questions on the new Form 1099-NEC form or account mapping in QuickBooks? Visit with one of our experts by calling (888) 388-1040.QuickBooks Online Self-Employed is the best option for you if you are just starting out as a sole proprietor with simple accounting needs, but would still like help organizing it all. You can save and close the 1099 Wizard at any time to make any changes needed in the Vendor or Chart of Account area(s). The steps on the screens that follow will allow you to review the information to make sure everything is included. Mapping the accounts can be done in the drop downs provided under each category. Go to the Vendors screen and choose Prepare 1099s. You will need to toggle between 1099 types to view each report. Run a 1099 Summary report to verify all the needed changes have been made.

Note: the accounts shown are for example only – your accounts may differ in number and/or name. As a result, the account mapping in your QuickBooks file will need to be updated for the 1099 reports to be correct. The amount that used to be input in Box 7 Nonemployee Compensation on Form 1099-MISC is now reported on Box 1 Nonemployee Compensation on Form 1099-NEC. The IRS added an additional form to be used when filing 1099s for 2020 – Form 1099-NEC.

0 kommentar(er)

0 kommentar(er)